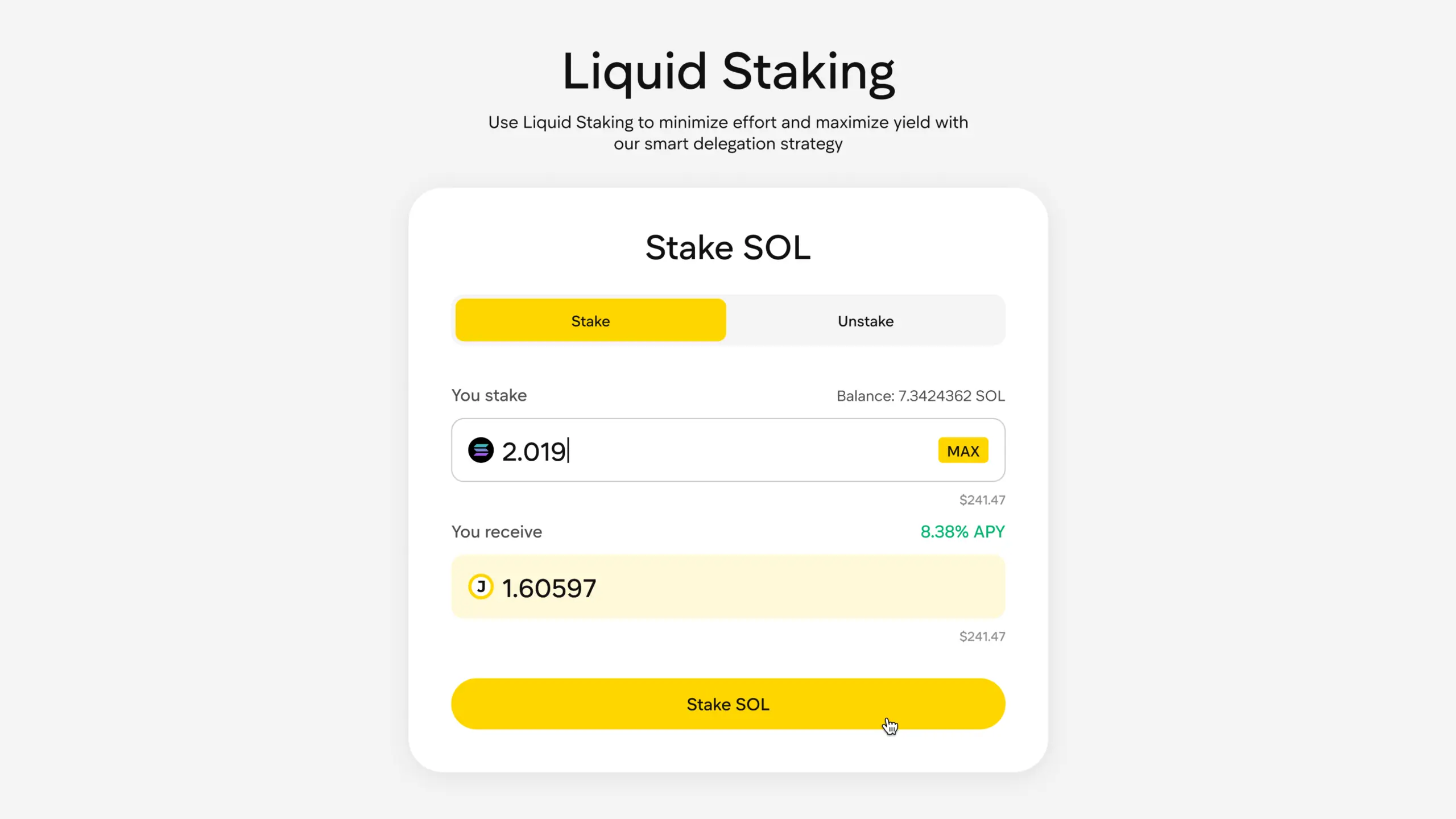

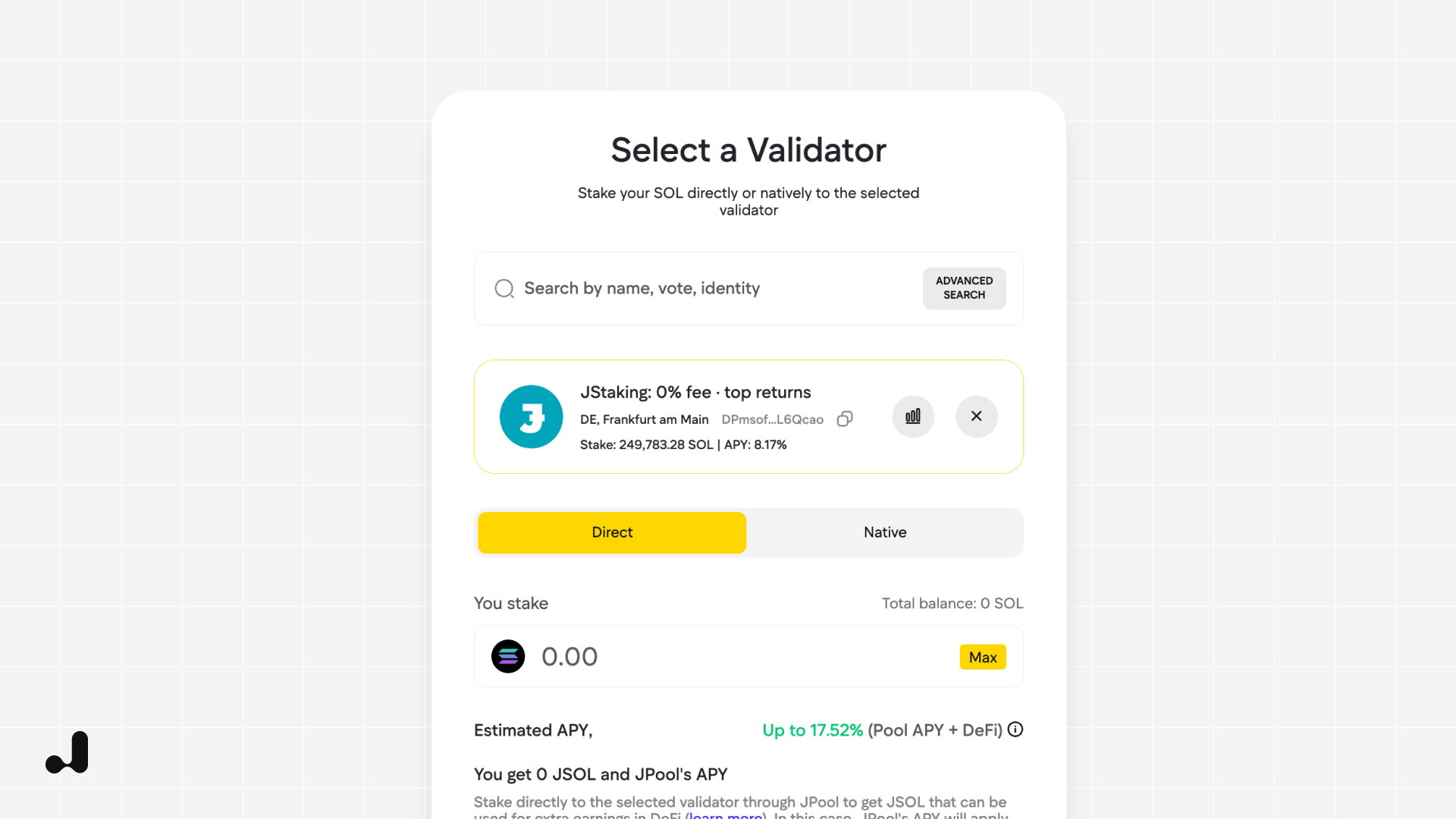

If you’re holding JSOL, you’re already earning staking rewards. But the moment you start using it across DeFi, you unlock something far more powerful — staking rewards + extra yield on top. That’s the core idea behind it: letting your staked SOL work in multiple places at once.

This guide breaks down the main DeFi opportunities on JPool’s Explore DeFi page, and explains when each one makes sense. Whether you’re still learning DeFi or already yield-hunting, you’ll find a path that fits your risk and experience level.

Why Use JSOL in DeFi Instead of Keeping It Idle?

JSOL represents staked SOL, whichcompounds staking rewards by default. But once you plug JSOL into DeFi, your tokens can:

- Earn layered yield (staking APY + DeFi APY).

- Serve as collateral for loans.

- Be provided as liquidity to earn fees.

- Help you build diversified yield strategies.

Think of JSOL as staked capital with mobility. You don’t have to “choose” between staking and DeFi. JSOL lets you do both.

1. Liquidity Pools: Earn Trading Fees with JSOL

For users who prefer steady, predictable yield, liquidity pools are usually the first stop. By supplying JSOL together with another asset, you earn a share of trading fees and sometimes additional rewards.

JSOL / SOL Pools (Multiple Platforms)

Available on: Meteora, Raydium, Orca.

A JSOL/SOL pool is one of the simplest ways to provide liquidity. Because JSOL is JPool’s liquid staking token backed by SOL and is designed to closely track SOL’s price with yield on top, JSOL/SOL pools typically experience much lower impermanent loss (IL) than uncorrelated or highly volatile pairs.

Who it fits:

- You want to keep exposure to SOL.

- You want a low-maintenance DeFi yield.

- You’re comfortable with minor IL in exchange for fees.

JSOL / USDC Pools: For Yield + Stability

If you want yield but prefer a more stable pairing, JSOL/USDC pools offer a balance. Because roughly half of your position sits in USDC, your overall exposure to SOL’s price swings is reduced compared with a pure JSOL/SOL position. You’re taking partial SOL risk and partial stablecoin stability.

Who it fits:

- You want to earn fees but reduce SOL volatility.

- You’re stacking yield without going full-risk.

- You want a “middle-ground” LP position.

2. Lending: Use JSOL as Interest-Earning Collateral

The moment JSOL becomes accepted as collateral, stakers unlock a new play: borrow other assets while keeping your staking yield and exposure.

JSOL Lending via Sanctum

Users can deposit JSOL and borrow against it. This suits people who want liquidity without unstaking or selling.

Why it’s useful:

- Access liquidity without losing SOL exposure.

- Borrow to farm, trade, or hedge.

- Keep earning staking yield while using capital elsewhere.

Best for intermediate users who understand borrowing risks and want to unlock capital efficiency.

3. Yield Stacking: Combining Multiple JSOL Utilities

This is where JSOL becomes interesting. Yield stacking means earning multiple streams from the same underlying tokens. A simple example:

- Stake SOL → Receive JSOL.

- Deposit JSOL into a lending platform.

- Borrow SOL or USDC.

- Provide it as liquidity for extra yield.

It’s the same money working 2–3 layers deep.

Stacked yield sources:

- JSOL staking yield.

- Lending deposit APY.

- Liquidity provision fees.

This strategy isn’t for newcomers, but it’s a powerful tool once you understand risks.

4. When to Choose Each JSOL DeFi Strategy

| Strategy | Best For | Risk Level | Key Benefit |

|---|---|---|---|

| JSOL/SOL pool | Long-term SOL believers | Low–Medium | Earn fees without losing SOL exposure |

| JSOL/USDC pool | Balanced approach | Medium | Partial volatility hedge + fees |

| Lending (collateral) | Capital efficiency seekers | Medium–High | Borrow without unstaking |

| Yield Stacking | Experienced DeFi users | High | Multiple yield layers |

How to Think About Risk Before You Jump In

Even “safe” DeFi isn’t risk-free. Before allocating JSOL anywhere, check these:

- Impermanent loss: relevant for liquidity pools.

- Smart contract risk: depends on platform maturity.

- Token volatility: especially in JSOL/USDC pools.

- Borrowing liquidation risk: if using JSOL as collateral.

- APY fluctuation: DeFi yields change based on liquidity & volume.

Why JSOL Is Naturally Suited for DeFi

Some staked assets aren’t widely used in DeFi. JSOL is becoming a “DeFi-native” liquid staking token on Solana for a simple reason:

- It behaves like SOL

- It earns staking yield

- It moves freely across DeFi

- It avoids long unstaking periods

It’s designed for users who want a productive version of staked SOL, not a locked one.

Final Thoughts: Start Simple, Then Expand

If you’ve never taken JSOL into DeFi before:

Start with one pool → see how it performs → then scale into more complex strategies.

A possible progression path:

- JSOL/SOL LP (beginner-friendly).

- JSOL/USDC LP (balance volatility).

- Lending for collateral (unlock liquidity).

- Yield stacking (advanced).

JSOL gives you flexibility. Whether your goal is conservative fee-earning or stacked yield strategies, the DeFi side of Solana offers plenty of ways to compound.

If you already hold JSOL, you’re not starting from zero — your base yield is working. Everything else you do in DeFi is an optional “boost.”